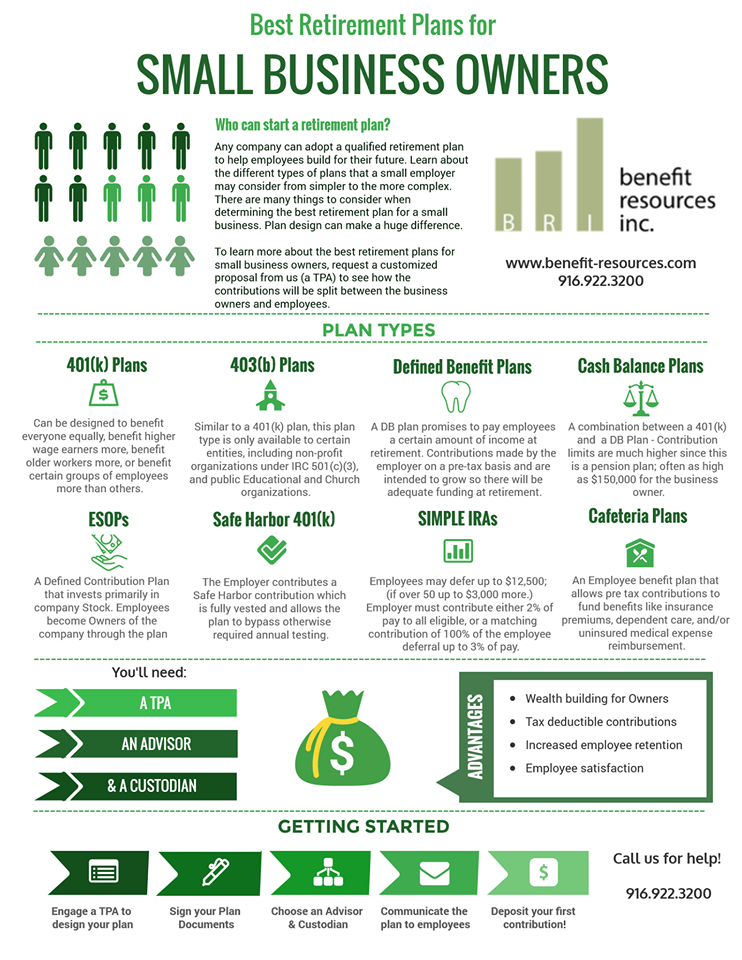

So we turned one of our hot blog posts into an infographic – easy to digest and share!

Part of getting a retirement plan set up is administration of the plan, which is the responsibility of the employer who adopted it. Many of these functions are often outsourced to a Third Party Administrator (TPA) like us. The Employer should take care in engaging a TPA that will perform the responsibilities with diligence and care. As the employer, you should make sure to review the TPA service agreement so you understand completely your responsibilities and what the TPA is responsible for.

Among the responsibilities of the administrator are:

- Plan document drafting and maintenance

- Compliance testing to ensure all rules and regulations are being followed

- Preparation for reporting of annual plan activity to government agencies

Work carefully with your TPA (us) to make sure you get the plan you are looking for and all functions are performed to your satisfaction and in a timely fashion.

{{cta(’50e9edd9-5231-46b6-a19d-7d8cf4e5db82′)}} {{cta(‘d06a3a4b-fdfe-47a0-aa5c-793495ca654b’)}}

Image courtesy of Rebecca Giannini / Benefit Resources, Inc.