Have you ever wondered what the third-party administrator (TPA) of your retirement plan does for you? Are you at a loss for a way of figuring out whether or not they’re doing a good job? Do you know the name of your TPA or whether you even have one at all? Well, you’re not the first to ask!

While maintaining a 401(k) plan may not be that difficult, it turns out that proving to the IRS that you’ve been doing it right this whole time requires knowledge most business owners and HR specialists don’t have and, to be honest, don’t have the interest in developing. This is where your TPA comes in! We help you demonstrate proper plan administration in case the IRS ever opens the hood on your plan so you can focus on running your business. The bottom line is that you do not need a TPA, but you do need to prove your plan is in compliance at all levels of administration and you never know what might come to the attention of authorities (and those meetings are never fun no matter how many TPAs you might have). So how many “levels” of plan administration are there? Here are some:

- Making correct salary deferral determinations each pay period and funding them on time

- Ensuring plan distributions are in accordance with the document and made in the correct amount (not to mention to the right person…ask how I know)

- Satisfying annual compliance testing such as the Average Deferral Percentage (ADP) test, coverage, and top-heavy testing

- Properly classifying employees (these include, “key”, “highly compensated/HCE”, “non-highly compensated/NHCE”, and “former key”)

- Correctly determining eligible compensation

- File the appropriate Form 5500 each year

- Identifying when the plan meets the definition of “large”, therefore requiring an independent annual audit

- Ensuring all contributions stay within current plan limits

- Incorporating changes (aka, amendments) to your plan required by the IRS

- Making other amendments to your plan correctly

- Properly correcting mistakes made during plan administration (we all do it!)

- Enrolling new participants at the right time and properly communicating the plan to them

- Ensuring all required notices are provided on time to the right group of plan participants

Since TPAs are not usually involved in most of the day-to-day administration like funding the plan each pay period or offering the plan to new participants, yours isn’t likely to be actively assisting you in all of these items and that’s okay! Primarily, TPAs pick up the annual compliance testing, check plan limits, prepare your Form 5500, maintain your plan document for required or requested amendments, and assist with plan corrections.

If you have a TPA and are wondering how you might be able to tell if they’re doing a fantastic job, you might ask them how they help you to identify and correct common errors made by businesses over the course of the day-to-day administration. Here are a few of them:

- Late deposit of deferral contributions made by employees

- Failure to file Form 5500 on time

- Improper classification of employees

- Failure to identify affiliated service or controlled groups of companies

- Deposits made to the wrong employee, in the wrong amount, and/or to the wrong contribution/money type

- Failure to offer the plan on time to eligible employees or allowing employees to participate too early

- Failure to fund company contributions properly or at all

Honestly, each of these problems is easy to make or overlook because not all of them are very obvious. It takes a seasoned TPA who is invested in the success of your plan to ask the right questions in the right way in order to get in front of some of these and Benefit Resources takes the time to do it! Despite everyone’s best efforts, though, mistakes are bound to happen so knowing how to properly correct these errors is also very important.

Finally, there are many plans that do not need a TPA, like SEP and SIMPLE IRA programs. All 401(k) plans, though, even “solo 401(k)” or “owner-only” plans, would be well served by a quick once over each year by a good TPA to ensure the definition of compensation is correct and to advise when a Form 5500 will be required for the first time.

Many plans, large ones in particular, receive document and compliance (i.e., TPA) services from their payroll provider or plan trust recordkeeper; these are called “bundled” providers. Bundled providers are convenient because you’ll have fewer providers to call if you have any questions and fewer bills to pay. The two most commonly reported inconveniences of bundled providers are either poor service or reporting errors that lead to expensive consequences. The latter is often attributable to the information the bundled provider receives from a plan sponsor who doesn’t understand the questions posed to them. For example, if you didn’t think that the kids of the owner should be classified as highly compensated/HCE because they only earn $20,000 a year, many bundled providers won’t follow up to confirm the potential relationship (despite having the same last name) and now your testing may be incorrectly performed.

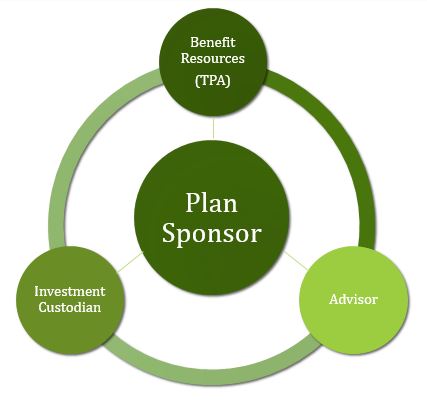

In conclusion, I love my job! We get to help our clients focus on their businesses with the confidence that BRI is only a phone call, email, or text away from helping them with anything they need, will recognize when mistakes are made and jump in to fix them, and will do whatever it takes to ensure necessary actions are performed on time. We have made understanding the rules and adapting to the changing landscape of regulation our career and are eager to figure out which recommendations we should make to each client to ensure their administrative efforts either don’t become more complicated or, if they need to be, how to minimize the impact as much as possible. If you are unsure whether your provider team could be improved, give Benefit Resources a call and perhaps we can put your mind at ease.

{{cta(‘6e97d841-f7bf-4536-8a9e-05b273291420’)}}

{{cta(‘4b075947-3849-4086-a12a-d5ea94d84d44’)}}