List of to-dos when starting a retirement plan

So you’re ready to start your retirement plan! Our pension consultants at BRI are ready to help you through the process from start-to-finish. Following are the decisions we’ll help you make to design a plan that is just right for your company.

You can use this as a sort of checklist to make sure you are on track to having a successful retirement plan – of course if you work with us, we will take care of keeping track of these details while you do what you do best.

1. Company details

- Information about your company

- Tax ID number

- Fiscal year

- Ownership and officers

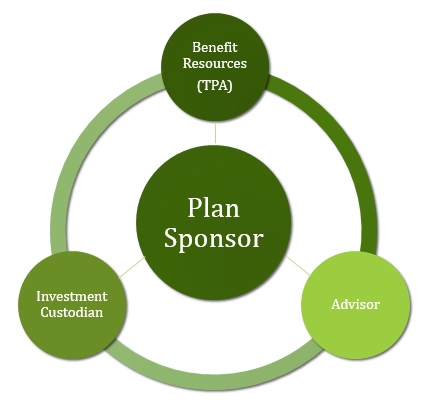

2. Plan operations

- Trustees – individual or institution

- Investment decisions – participant driven, or trustee managed

- Payment of fees – by sponsor, by plan, or combination

3. Plan Investments

- Financial advisor

- Investment custodian

- Recordkeeping functions available

4. Eligibility provisions

- Waiting period for employees to make contributions (if any)

- Waiting period for employer contributions

- Age restriction

- Entry date once waiting periods are met

- Automatic enrollment options

- Employee contributions (401(k) or 403(b)

- Pre-tax and Roth options

- Employer match – fixed or discretionary

- Employer profit sharing – allocation formula

- Safe Harbor – match or non-elective

6. Vesting provisions

- Immediate, cliff-schedule, or graded-schedule for employer contributions

7. Distribution payments

- At termination from service

- At retirement, death, or disability

- In-service withdrawal options

- Hardship withdrawals

- Loan provisions

A retirement plan trust is a legal document, so you certainly want a specialist to help you design it properly. You’ll also want an expert to help you administer the plan every year to make sure that all plan design provisions are being followed, that compliance tests are being met, and that government reporting is timely and accurate. Benefit Resources wants to be your TPA of choice. Contact us today to go through the decisions to design the perfect plan for you.

{{cta(‘45975e18-0c46-4b42-a10a-636ed08956ac’)}} {{cta(‘2b0c9607-266e-4f8a-a78b-aee9715266fc’)}}

You might also like:

What’s the best pension plan for you?