There are a few options that are great for Small Business Owners looking to set up a 401k Plan for themselves and their employees. Small Business 401k Plans are easy to set up, especially if you have a TPA helping you every step of the way. We do the back end work while you focus on your business. L earn more about 401ks and some other options you may not have heard of below.

earn more about 401ks and some other options you may not have heard of below.

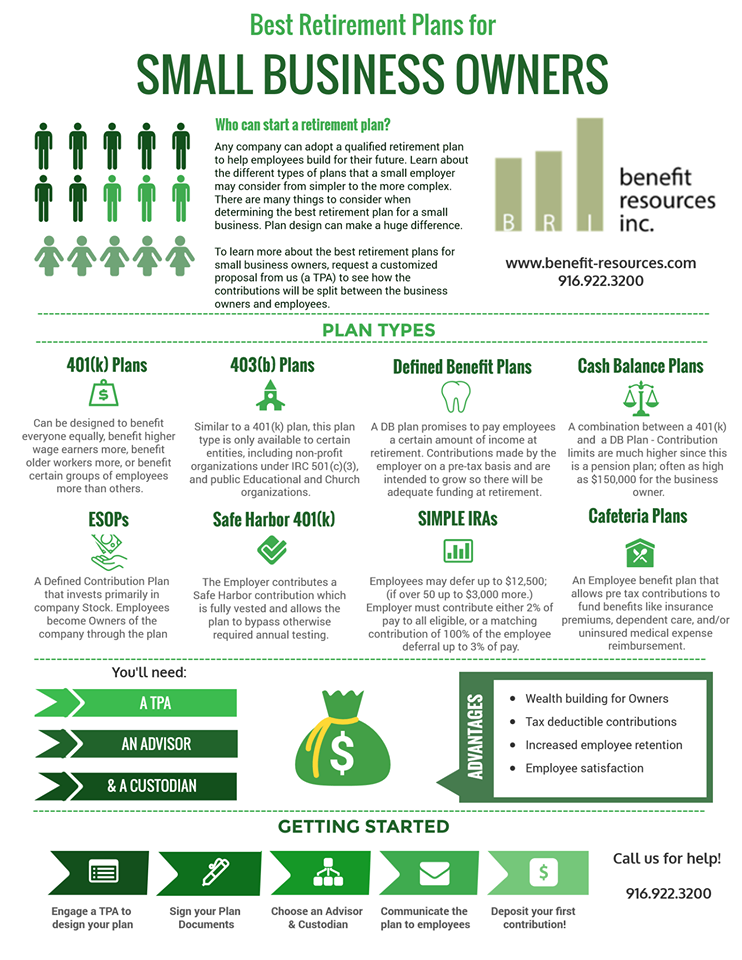

If you are a visual learner, there’s an infographic at the bottom of the post that will help.

401(k) PROFIT SHARING

Eligibility: Employees can be required to work 1000 hours in their first 12-months, and be at least age 21 before being eligible for the plan. Entry into the plan can be immediate, monthly, quarterly or semi-annually.

Contributions: Employees may defer up to $16,500; those age 50 and over can contribute an additional $5,500 catch up. Employee contributions may be Roth or pre-tax. Maximum of all deposits cannot exceed $49,000 per year ($54,500 with catch up).

Employers may contribute either a matching contribution and/or a Profit Sharing contribution. A variety of formulas can be used for either of these contributions and can be designed to benefit everyone equally, benefit higher wage earners more, benefit older workers more, or benefit certain groups of employees more than others. These offer a great deal of flexibility.

Deferrals must be deposited each pay period; Employer contributions must be deposited by the due date of the sponsoring employer’s income tax return.

Investments: Accounts are all registered to the name of the plan. Those accounts may be participant-directed or trustee-directed or both. Employer contributions may be subject to a vesting schedule up to 6-years long.

Distributions: Participant must suffer “triggering event” before allowed to withdraw funds (retirement, termination, death, or disability). Hardship withdrawals, in-service withdrawals, and/or loans may be made available.

Filings: Form 5500 filing is required 7-months after the end of the plan year. The 5500 filing and compliance testing is provided by TPA.

Deadline: Plan documents must be adopted by the last day of the plan year. Deferrals cannot begin until documents are signed. Plans may be run on calendar or fiscal year.

SAFE HARBOR 401k PLANS{{cta(’22f4930e-471c-4136-ac2b-437c2c38237f’,’justifyright’)}}

There is a variation of the standard 401k Plan, called the Safe Harbor 401k Plan and one of the many benefits of this type of plan is that you avoid the annual testing required in the regular 401k. Learn all about Safe Harbor 401k Plans here.

CASH BALANCE PENSION PLAN

Eligibility: Employees can be required to work 1000 hours in their first 12-months, and be at least age 21 before being eligible for the plan. Entry into the plan can be monthly, quarterly or semi-annually.

Contributions: Employer contributes a “pay credit” (percentage of pay or flat dollar amount) and an “interest credit” (typically 4%-5%) to each eligible employee’s account each year. These are mandatory contributions for a minimum of 5 years. Contribution limits are much higher since this is a pension plan; often as high as $150,000 for the business owner. Employer contributions must be deposited by the due date of the sponsoring employer’s income tax return.

Investments: Accounts are all registered to the name of the plan. Those accounts are always trustee-directed. Employer contributions may be subject to a 3-year cliff vesting schedule.

Filings: Form 5500 filing is required 7-months after the end of the plan year. The 5500 filing and compliance testing is provided by an actuary and TPA.

Deadline: Plan documents must be adopted by the last day of the plan year. Plans may be run on calendar or fiscal year. Cash Balance plans are often combined with a 401(k) Profit Sharing plan to maximize the benefit to the business owner.

LEARN MORE ABOUT CASH BALANCE PLANS IN THIS RELATED ARTICLE.

ESOPs{{cta(’50e9edd9-5231-46b6-a19d-7d8cf4e5db82′,’justifyright’)}}

ESOPs or Employee Stock Ownership Plans are a little more rare these days, but still are an option and are perfect for some employers. Learn all about ESOPs here.

To learn more about the best retirement plans for small business owners, request a customized proposal from us to see how the contributions will be split between the business owners and employees. Retirement plans are one leg of financial planning’s three-legged stool, so get started as soon as you can, and deposit as much as you can so that you and your employees will be able to enjoy a comfortable retirement.

Related Articles:

How to Set up a 401k – 4 Steps

SMALL BUSINESS 401k PLANS – Design Features and Risks Part 1

SMALL BUSINESS 401k PLANS – Design Features and Risks Part 2

Photo courtesty of lekkyjustdoit / FreeDigitalPhotos.net