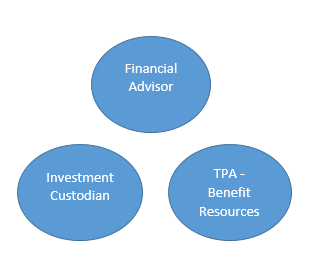

You’ll need to select one of each of the 401k Companies listed below for you to get started with a 401k. If you need recommendations for any of the provider types, we can help with that too. After we go through the companies involved in setting up a company 401k, we’ll talk about what your next step should be.

Retirement plans are a team sport. If you’re ready to start a retirement plan we want to help you understand the various retirement plan providers so you can keep the players straight and understand their roles. We recommend that companies look for providers who are an expert in their respective role, and who communicate openly with the other plan providers. This will create a well-run plan and allow peace of mind for the company sponsoring the plan.

TO START A 401K – YOU’LL NEED:

1.) A PLAN SPONSOR (that’s you or your client if you are a financial advisor)

The company that offers the plan for their employees is considered the Plan Sponsor. When starting a retirement plan everything with respect to the design of the plan should revolve around what the Plan Sponsor’s needs are. Ultimately the day-to-day responsibility for the Plan lies with the sponsor, but a good TPA will help you with these responsibilities:

- Enroll eligible employees

- Deposit contributions to the plan

- Authorize of benefit payments

- Confirm compliance

- Submit annual government filings

Plan Sponsors rely on the assistance of professionals to help them fulfill their responsibilities. Those various providers are described below.

2.) A FINANCIAL ADVISOR

The financial advisor is a person or company that helps you select the right investment mix and provider for your plan. A responsible advisor will perform some of the following functions: {{cta(‘3d5265ad-1911-44cb-9643-f742cb91507d’,’justifyright’)}}

- Prepare an Investment Policy Statement

- Help select the investments available within the plan

- Monitor the investments regularly

- Meet with the Plan investment committee at least once per year

- Provide information and education to employees about the Plan and investment strategies

3.) AN INVESTMENT CUSTODIAN

Investment Custodians hold the money for the Plan and its participants. Custodians perform a variety of functions for a Plan including some or all of the following:

- Post investment trades

- Allocate dividends and fees

- Provide recordkeeping services

- Maintaining a website for Plan participants to get information about their account

- Prepare statements for the Plan and/or the participants

4.) A TPA (Third Party Administrator) – That’s what we do.

An independent TPA assists the Plan sponsor in meeting their responsibilities for setting up and administering the plan. We will design the plan around your needs, set it up and maintain it. Just like a good CPA helps you follow tax law, a good TPA helps you follow ERISA laws. The TPA reviews activity during the year to confirm that the Plan Sponsor followed the rules and regulations including:

- Follow and maintain the Plan documents{{cta(’50e9edd9-5231-46b6-a19d-7d8cf4e5db82′,’justifyright’)}}

- Perform testing of the plan to confirm that all compliance rules are met

- Prepare required government filings and reports to be filed

- Answer questions from the Plan Sponsor throughout the year

We are the premier online 401k company, we answer the phone and know our clients by name, not account number.

5.) A CPA

Plans with more than 100 eligible Participants must have the Plan’s financial statements audited by a CPA each year. Auditors have very specific guidelines, and they provide a valuable service to the Plan Sponsor to confirm eligibility, payroll deposits, posting details and the like. They confirm that the correct data is being provided to the TPA for testing purposes, that the investments are being reported accurately on the financial statements and reports being provided to the government.

THINGS TO CONSIDER

The reasons why you’ve decided to learn how to get a retirement plan set up for your company will help you design the right plan for you. Remember the four “R”s to help you get a handle on what’s important to you and decide how to get a retirement plan set up that meets your needs:

- Recruit – Is a plan important for your recruiting efforts? Will your prospective employees be satisfied with a 401(k) deferral-only plan? Are your competitors offering more? Your industry may dictate what type of employer contribution your recruits expect.

- Reward – Do you want a plan designed to reward your current employees? You can draft a plan around existing incentive programs.

- Retain – There are certain plan provisions, such as a vesting schedule, that will provide your employees an incentive to stay with you.

- Retire – It is important for business owners and employees to have an account balance that will help them retire comfortably. You may want to start with this end in mind: if I want to have a certain balance at my retirement age, how much will I need to commit to saving each year to meet that goal? Perhaps you should consider a pension plan in addition to a profit-sharing plan to increase contributions.

CHOOSE PLAN DESIGN AND DOCUMENTS – design options are listed below, but if you’d rather just have someone walk you through each of these one the phone with you, request contact here for personalized help deciding on these options.

Once you have outlined your goals for what the plan will look like, you can figure out how to have your retirement plan set up to fit your needs. Even prototype plans offer options for employers to draft a semi-custom document:

- Waiting period – How long does an employee need to wait before he or she becomes eligible for the plan? You can offer immediate entry or require up to a one-year wait for 401(k) plans.

- Age – You can require that an employee be 21 years old before they are eligible for the plan. Any age below that is allowed as well; it’s up to you!

- Open enrollment periods – When will an employee be allowed to enroll once they have satisfied the waiting and age requirements? Options include immediate, monthly, quarterly, semi-annually, or annually.

- Contributions –

- Will the plan include the option for employee contributions? Will you include a Roth (after-tax) option in addition to the pre-tax option?

- Will you fund a matching contribution? If so, will you have a fixed formula or leave the decision about the amount until the end of the year?

- You may wish to include a pension plan to maximize the amount of employer contributions that can be deposited to retirement accounts each year.

- Vesting – Will employer contributions be subject to a vesting schedule? Vesting options range from 100% immediate vesting to three-year cliff vesting (0%, 0%, 100%) to six-year graded vesting (0%, 20%, 40%, 60%, 80%, 100%).

- Forfeitures – Employer contributions are forfeited by employees who are not fully vested. Forfeitures can be used to pay fees, offset employer contributions, or allocated in addition to employer contributions.

- Retirement age – At the plan’s defined Normal Retirement Age (NRA), a participant becomes 100% vested in all accounts. NRA can be a specific age such as 59 ½, 62, or 65 or have a qualifier; for example, age 65 plus five years of participation.

- Distribution options – Will the plan only offer lump-sum distribution? Would you like the plan to offer installment payments and/or annuity benefits as an option? What about loans or withdrawals due to financial hardship?

- Compliance testing options – All plans are subject to compliance testing, but many tests have alternatives available:

- 401(k) non-discrimination can use either prior-year or current-year testing methods

- 401(k) testing can be avoided if Safe Harbor contributions are offered

- Definition of Highly Compensated Employee can be limited to the top 20% of employees

- Top-heavy contributions can include or exclude Key Employees

Give us a call at 916.922.3200 and we will get you on your way. Having multiple providers for your Plan, like the ones listed above, brings strength in each specialty to provide you with the best possible outcome. 401k Companies who bundle services may have a weak link that isn’t identified until you are already deep into the process – then it may be difficult or impossible to swap out that weak player.

TAKE ACTION!

We would be proud to help walk you through the process of starting a retirement plan, and help you find the right providers for your needs. Click here to have one of our pension consultants contact you!

You might also like:

The Complete Guide to Choosing, Setting Up & Maintaining A Company Retirement Plan

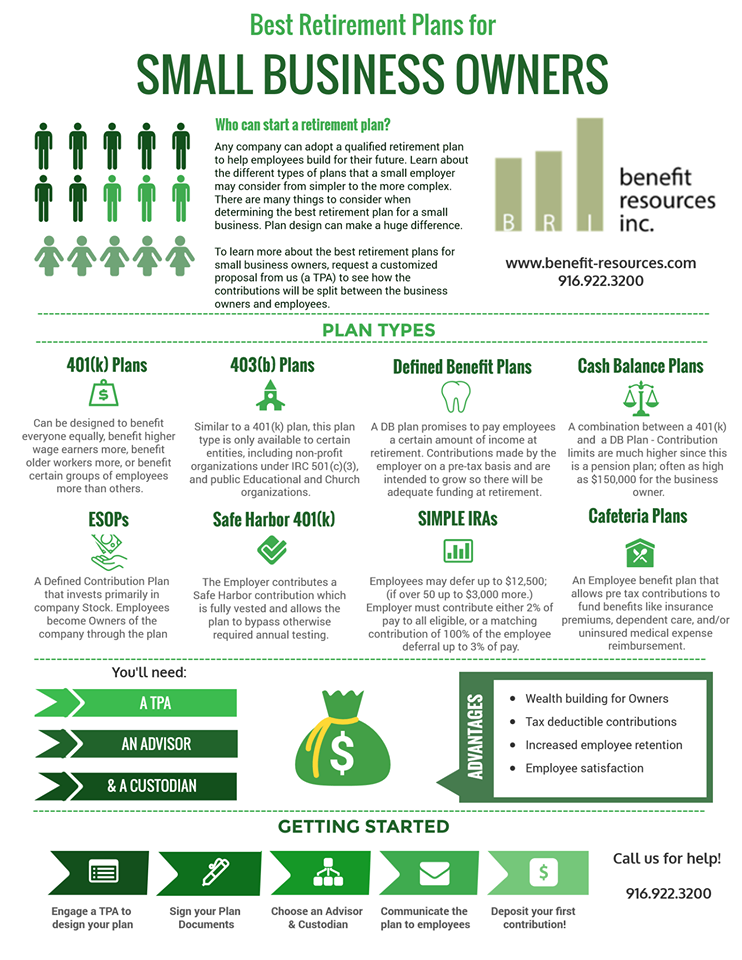

Best Retirement Plans for Small Business Owners